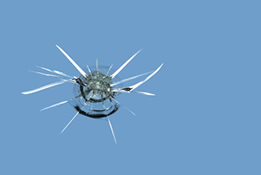

Auto Glass Repair and Replacement

Almost every motorist will experience a broken or chipped windshield at one time or another. Even if the damage looks minor, there are serious repercussions that can result from neglecting to have the windshield or auto glass repaired or replaced in a timely manner. For example, a rock chip can expand and produce a major crack that inhibits visibility. Some industry specialists can repair chips, cracks and nicks under 6 inches with ease, making it simple to restore the structural integrity and maintain the windshield. Other types of auto glass damage can include (but are not limited to) vandalism, burglary and storm damage such as hail. A lot depends on the location of the damage. For example, if your line of sight is impeded by the damage, it may be necessary to replace the entire windshield instead of attempting to repair it. The auto glass repair specialists who contract with your insurance company will be able to determine if the window can safely be repaired or needs to be replaced.

If I File an Auto Glass Claim, Will My Insurance Rate Go Up?

Typically, auto glass repair or replacement claims against your comprehensive coverage do not affect car insurance rates, but this practice will vary from insurer to insurer. Before you file a claim, you should contact your agent to find out if glass coverage is included in your policy, and, if so, how much your rates will increase if you make a claim. Some insurers offer glass coverage with a $0 deductible, but you typically have to pay slightly higher premiums for this coverage. On some policies, your windshield is protected under your comprehensive coverage, but your deductible still applies. In other words, if you have a $500 comprehensive deductible and your window only costs $400 to fix, it would make more sense to pay out of pocket and avoid filing a claim.

What if I Only Have Liability Coverage?

Policyholders who only have liability coverage will typically not receive any auto insurance repair benefits from their company. Liability coverage only protects against damage to another vehicle. If you lack comprehensive coverage and need your windshield repaired or replaced, you can deal directly with the auto glass company. It may be tempting to put off getting a chipped windshield fixed on your own dime, but it will most certainly cost a lot more to do it down the road if the damage spreads.

To avoid paying more than you have to for auto glass repair or replacement, make sure you have adequate insurance coverage. Also, make sure you aren't paying too much for coverage by comparing quotes. We have taken much of the time and effort out of researching insurance rates by giving you the opportunity to compare quotes by filling out one simple form. Begin the form located on this page to save money today and protect your investment today!