Cheap Auto Insurance

If you've surfed the Web for prices, you know strategies to secure a cheap automobile insurance quote abound. Thanks to the fiercely competitive online marketplace, carriers routinely offer very cheap car insurance for almost any type of vehicle to drivers of all kinds. The availability of cheap motor insurance isn't really the issue at hand, though. Rather, drivers need to critically assess the trade-offs they are making by selecting a cheap car insurance quote. Often, the cheapest car insurance quote involves significant sacrifices in coverage quality, amount, flexibility, and so forth. The question you must ask yourself is if you are willing to make these sacrifices for a cheap auto insurance rate.

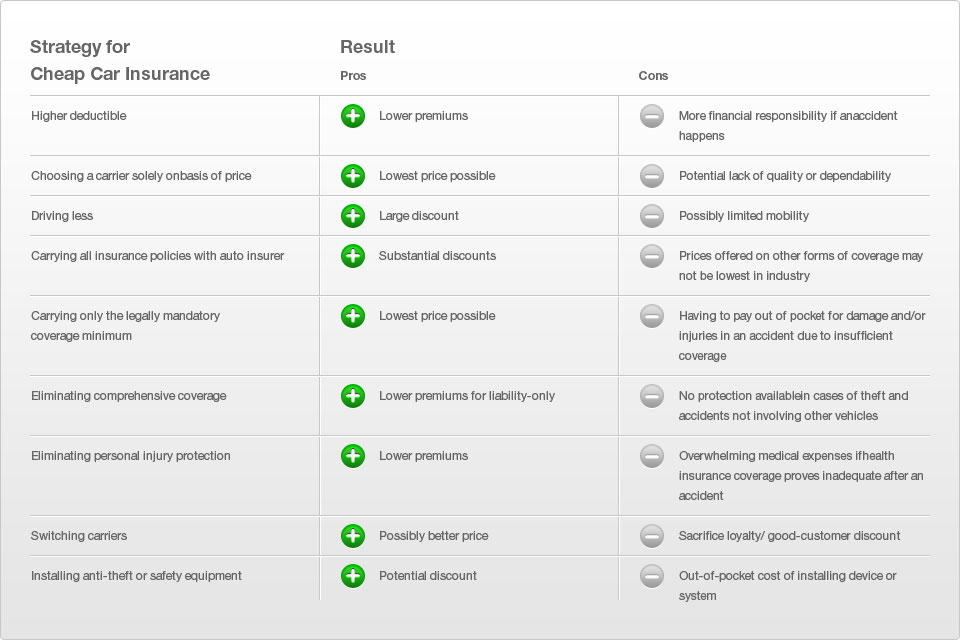

Is a Cheap Car Insurance Rate Worth the Trade-Offs?

For buyers whose goal it is to find the cheapest motorcycle insurance or auto insurance, small trade-offs are often well-worth the substantial savings. To a point, this buying strategy is a sound one. But buyers should still be aware of what and how much they are giving up in pursuit of a cheap auto insurance quote so they can make an informed coverage choice. Below, we've listed the changes consumers can make to their policies in order to secure the cheapest auto insurance quotes. After each strategy, you will also see a brief summary of the trade-offs involved in employing it.

Higher deductibles

If you raise your deductibles, your rate will drop, but your out-of-pocket costs if you ever have an accident will rise. Don't raise your deductible higher than you could comfortably manage to pay if such a loss occurs.

Choosing an insurer only on a cost basis.

Cheap car insurance quotes online are not difficult to find, but many of these offers come from untrustworthy carriers. Failing to consider other factors when you buy cheap car insurance, such as the dependability and service of your carrier, may lead to sky-high expenses down the road if the insurer proves unreliable.

Driving less frequently.

Curtailing the number of miles you drive will reduce your premiums, as it will often make you eligible for a low-mileage discount. However, unless you find other reliable ways to get around, your mobility could be restricted as a result.

Bundling all insurance with one provider.

One of the easiest ways to qualify for cheap auto insurance online is to bundle all of your insurance policies with a single provider, typically your auto insurance provider. While this will make you eligible for the valuable multi-policy discount, it may also mean that you don't get the lowest price on your other coverage, such as life or home insurance.

Carrying the bare minimum amount of liability.

Granted, it will be much easier to find cheap car insurance if you only purchase the legal minimum of liability protection. In the long run, though, this approach is penny wise and pound foolish. You could end up on the hook for thousands of dollars of damages and injuries if you have a serious accident.

Eliminating coverage that is not legally mandatory.

Cut-rate car insurance often requires you to eliminate coverage not mandated by law in most states, such as personal injury protection, comprehensive, or uninsured motorist protection. While jettisoning such coverage will lower your premiums, it also opens you up to massive financial responsibility if you have an accident or if your vehicle is damaged.

![[X] (click to close)](/images/x_close.png)