Rental Reimbursement Coverage

The logistical aftermath of an accident can be overwhelming. Between filing insurance claims, attending to any injuries you might have, and getting your car repaired, life can get very hectic in the weeks following a collision. If your car was damaged in the accident, you'll also have to worry about finding alternative transportation while the vehicle is replaced or repaired. The good news is that with car rental insurance coverage, your carrier will pick up the tab for your rental car, leaving you with one less thing to manage.

What Is Car Rental Insurance Coverage?

Also known as rental reimbursement coverage, car rental insurance coverage will compensate you for the cost of a rental car while your vehicle is repaired or replaced after a covered loss. The coverage is optional, but most drivers choose to include it in their policies because it affords valuable protection at a minimal additional cost. Note that this coverage does not apply to vehicles you elect to rent; the rental must be necessary following a covered accident.

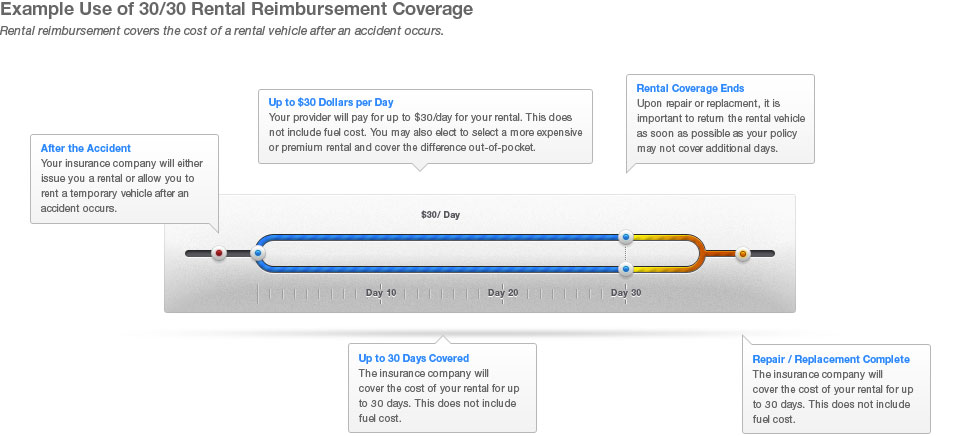

Typically, carriers describe rental car insurance coverage in terms of the daily limit on the dollar amount spent and the maximum number of days for which you will be reimbursed. For instance, a common rental coverage structure is $30 per day for up to 30 days. In other words, you would be reimbursed for the cost of the rental car up to $30 each day for a maximum of 30 days.

Do You Need Rental Car Insurance Coverage?

It is difficult to envision a scenario where rental reimbursement coverage would not be useful to a driver after an accident. Unless you have a spare vehicle that you could drive while yours is repaired, you can assume you will use car rental insurance coverage at some point. The protection it provides is significant, potentially saving you hundreds of dollars in rental car costs, but it adds only a few additional dollars to your monthly premium in most cases. Without it, you would have to foot the bill for any expenses related to the accident, such as deductibles, as well as the cost of alternative transportation.

Coverage Applied to Rental Vehicles

Take care not to confuse rental reimbursement coverage with the insurance policies rental car companies offer when you rent a vehicle. The former reimburses you for necessary post-accident rental expenses; the latter is a type of physical damage coverage that protects you from financial liability if you damage the rental vehicle in some way. Most policies extend their protection to rental vehicles if you carry physical damage coverage, so you might not need to purchase a separate policy, but you should always consult with your carrier first.

![[X] (click to close)](/images/x_close.png)